us japan tax treaty withholding rate

Us japan tax treaty dividend withholding rate. In the US withholding by employers of tax on wages is required by the federal most state and some local governments.

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

And Japan signed a new income tax treaty and a Protocol Notes and Understanding.

. Exemption on Your Tax Return. 151 rows Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation.

5 Article 5 Permanent Establishment in the Japan-US Income Tax. With Regard to Non-resident Relatives. The new convention reflects changes in the internal tax laws of the United States and Japan and takes into.

NEWUS-JAPAN INCOME TAX TREATY by Nancy M. Foreign tax relief and tax treaties. February 21 2022 how do carters reward points work.

The proposed treaty is similar to other recent US. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. Royalties or Business Profit Other Income Services. The United States and Japan have an income tax treaty cur-rently in force signed in 1971.

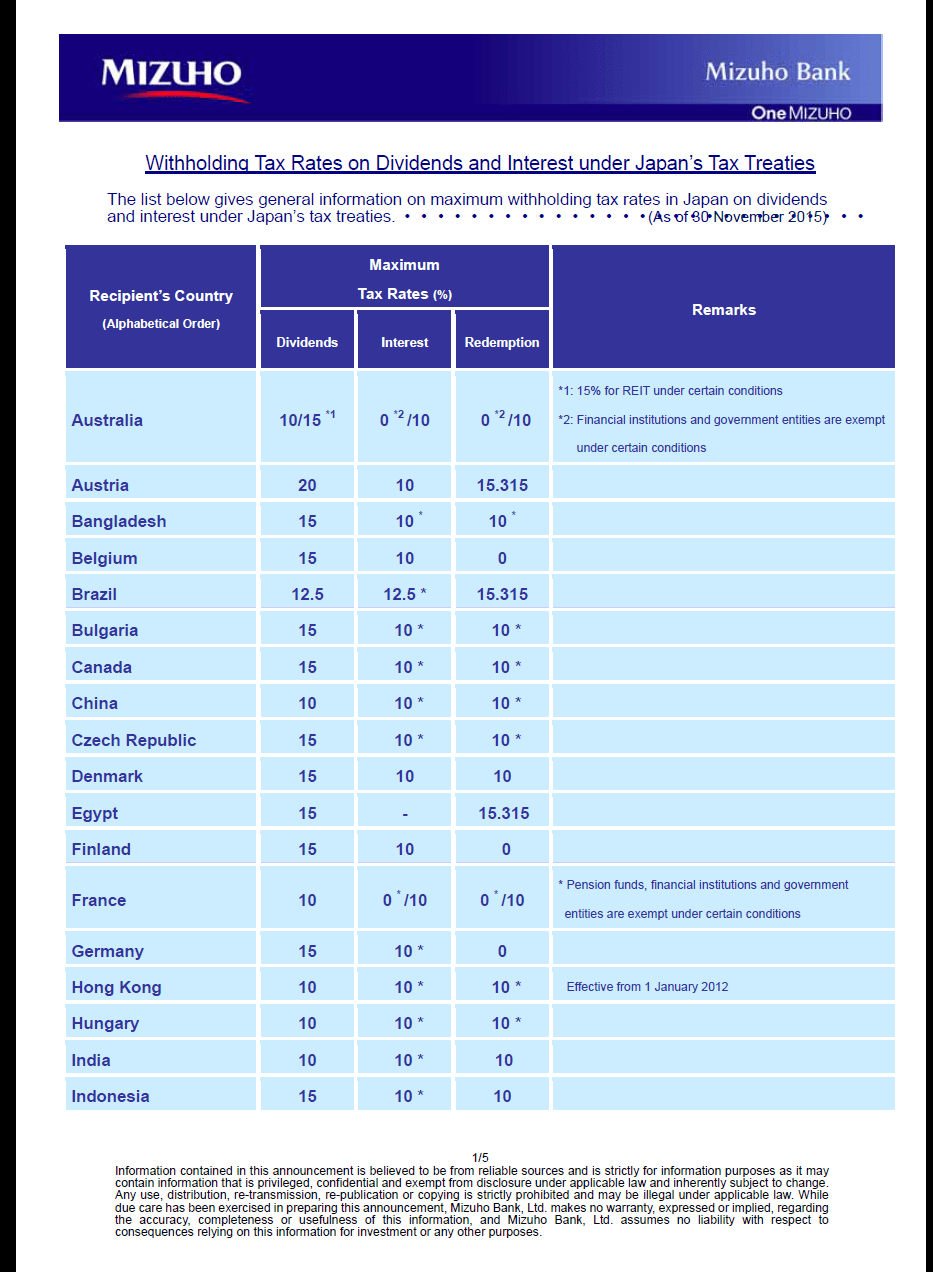

2 Saving Clause in the Japan-US Tax Treaty. The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 12 January 2022 Recipients Country. Japan is a member of the United Nations UN OECD and G7.

For 2022 this rate is 258 per cent. The following table lists the withholding rates for income type. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US.

Able to pay annual interest to non-UK residents free of WHT. Other tax credits and incentives. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of.

This article discusses the implications of the United States- Japan Income Tax Treaty. This table lists the income tax and. Rate of withholding tax Interest.

1 US Japan Tax Treaty. Last reviewed - 01 August 2022. Japan is comprised of 47 prefectures and eight regions.

Each prefecture is overseen by a governor. The withholding tax is levied at a rate equal to the highest rate of Dutch Corporate Income Tax in the current tax year. In addition most of the UK treaties provide.

Beckner Newville PA On November 6 2003 the US. Corporate - Withholding taxes. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties.

The proposed treaty would replace this treaty. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for. 25 0 15 or upon application as reduced by EU directivedouble tax.

The withholding tax rate. 4 Saving Clause Exemptions. Taxes withheld include federal income tax 3 Social Security and.

0 Korea South. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Japan Inbound Tax Legal Newsletter August 2019 No.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

U S Estate Tax For Canadians Manulife Investment Management

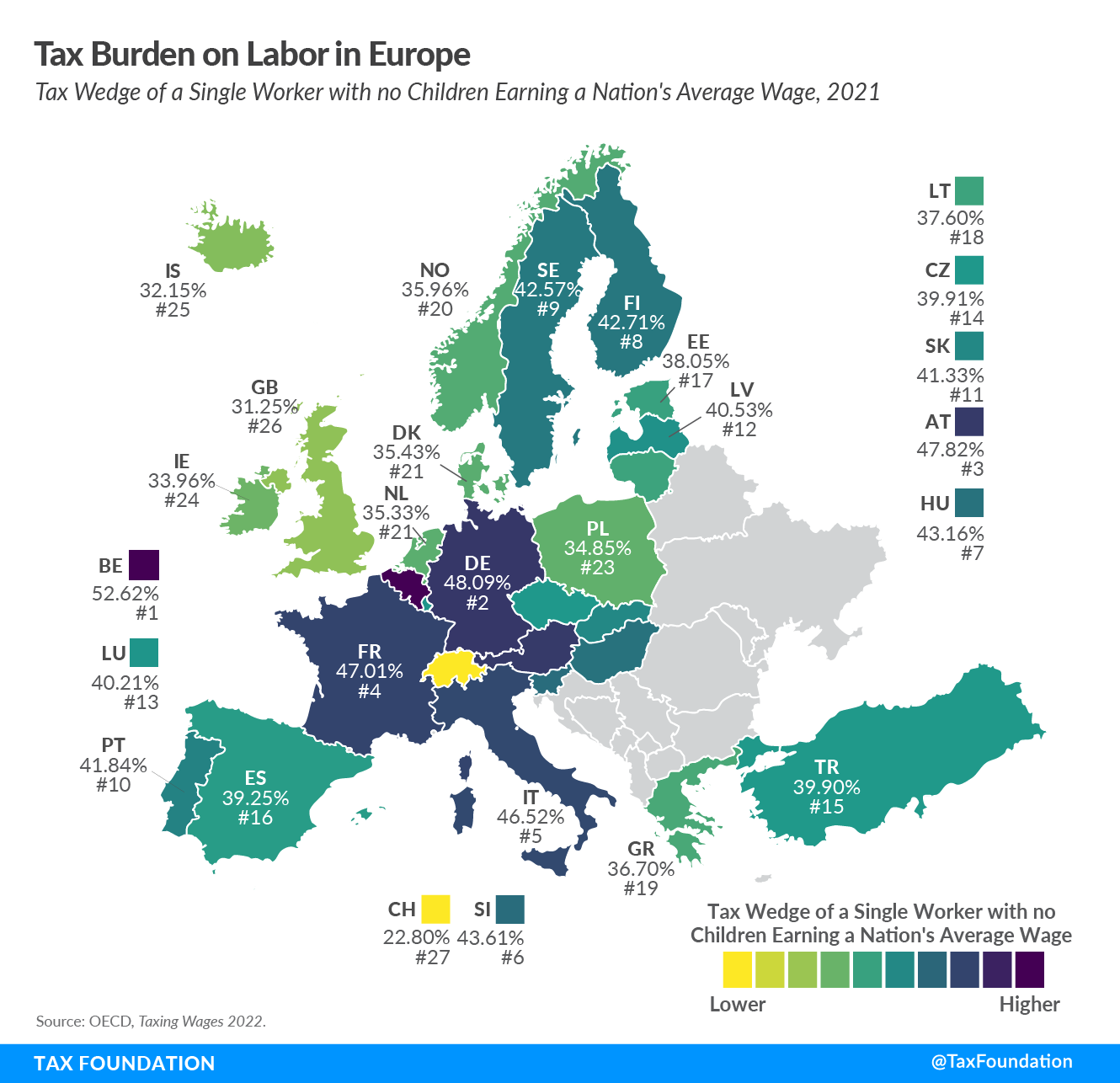

Portugal Tax Income Taxes In Portugal Tax Foundation

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan Dividend Withholding Tax Rates For Tax Treaty Countries Topforeignstocks Com

France Denmark Double Tax Treaty Finally Signed By Both Countries

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

Should The United States Terminate Its Tax Treaty With Russia

Form 8833 Tax Treaties Understanding Your Us Tax Return

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table